A Warning From Michael Saylor

Billionaire Michael Saylor's Warning To The World. It's Coming. Will YOU Be Ready?

Introduction:

In the intricate tapestry of global economics, fiat currency has long been the linchpin holding together the financial systems of nations. However, as we navigate the complexities of the modern financial landscape, cracks in the foundation of fiat currency are becoming increasingly apparent. This article explores the systemic issues and potential consequences surrounding the failure of fiat currency.

I. The Illusion of Value:

Fiat currency, by definition, lacks intrinsic value. Unlike commodities such as gold or silver, which have inherent worth, fiat money's value is derived solely from the trust and confidence of the people who use it. This trust, however, is not impervious to erosion. Central banks and governments have the power to print more money, leading to inflation and devaluation of the currency. This overreliance on trust has laid the groundwork for a potential collapse.

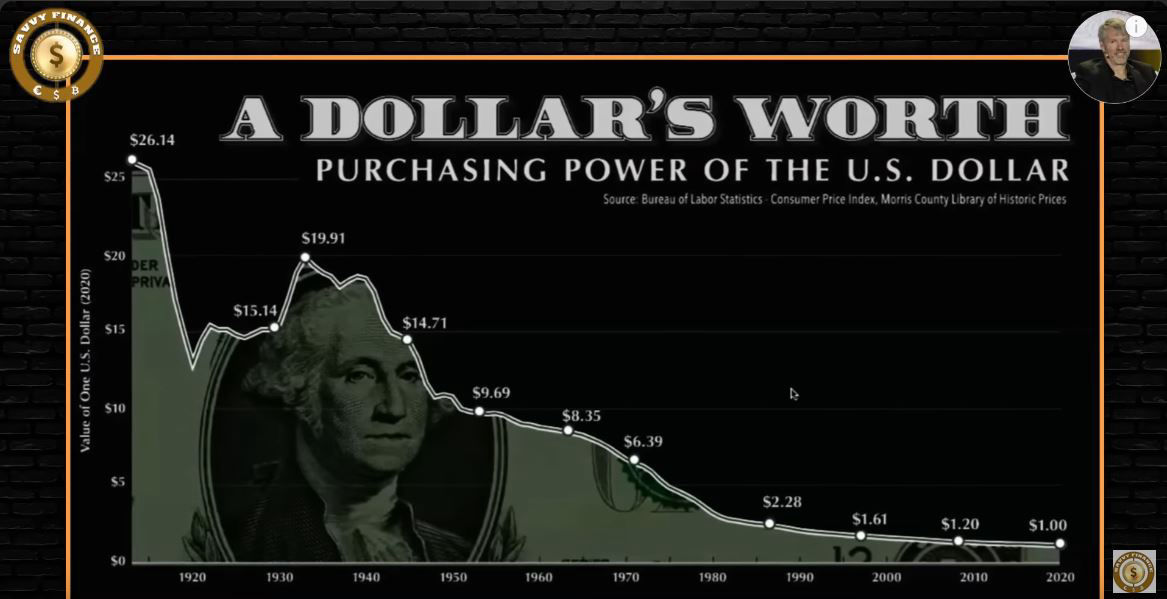

II. Inflationary Pressures:

One of the major pitfalls of fiat currency is its susceptibility to inflationary pressures. When central banks engage in excessive money printing without a corresponding increase in real economic output, it can lead to a surge in prices. As the purchasing power of the currency diminishes, citizens witness the erosion of their savings, and the cost of living rises. This vicious cycle can trigger a loss of confidence in the currency, resulting in a downward spiral that is challenging to rectify.

III. Debt Spiral:

Fiat currency systems often operate hand-in-hand with a debt-based monetary system. Governments accumulate massive debts, assuming they can continuously service them by borrowing more money. However, this perpetuates a dangerous cycle, as the burden of debt can become unsustainable. When the ability to service debts falters, it places immense strain on the currency, further undermining confidence and stability.

IV. Geopolitical Risks:

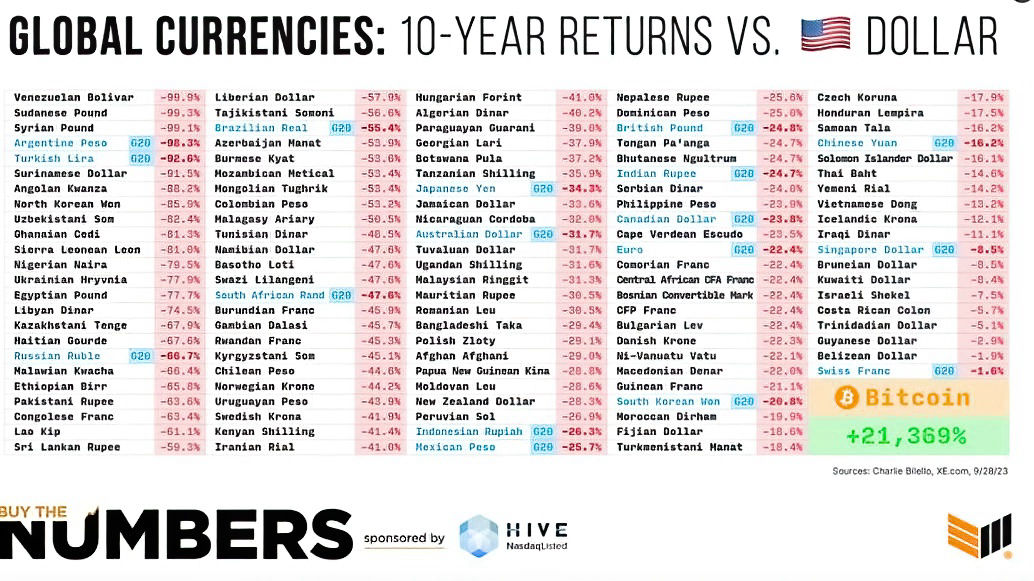

Fiat currencies are vulnerable to geopolitical risks and manipulation. Trade tensions, economic sanctions, and political instability can all contribute to the devaluation of a nation's currency. In a globalized world, the interconnectedness of economies means that a crisis in one region can have cascading effects on currencies worldwide, amplifying the risks associated with fiat systems.

V. The Digital Evolution:

The rise of digital currencies and cryptocurrencies poses both an opportunity and a threat to fiat currencies. While these digital alternatives offer potential solutions to some of the problems inherent in traditional fiat systems, they also challenge the established order. Central banks are now grappling with the need to adapt to a changing financial landscape, as digital currencies gain traction.

Conclusion:

As we confront the vulnerabilities of fiat currency, it becomes evident that a reevaluation of our monetary systems is imperative. Whether through increased transparency, responsible fiscal policies, or the adoption of innovative financial technologies, addressing the root causes of fiat currency failure is essential for safeguarding the stability of global economies. The road ahead may be uncertain, but acknowledging the shortcomings of current monetary systems is the first step towards creating a more resilient and sustainable financial future.

"I don't believe we shall ever have a good money again before we take the thing out of the hands of Government... All we can do, is by some sly roundabout way, introduce something that they can't stop"

- Friedrich Hayek, winner of the 1974 Nobel Prize in Economics -

Before you sign up for an exchange, it's important to take the necessary steps to protect your browsing and email communications against trackers, hackers and theives. It's not difficult. Here's how...

Once your browser and email privacy is secured, you will select an exchange where you can buy, sell, send and receive Bitcoin. Here is the one I recommend for newcomers. It's easy, fast, economical, safe and secure...

It's very important NOT to keep your Bitcoin on an exchange. You want to store your Bitcoin in a secure, COLD wallet. Here are the two easiest options for newbies. Bitcoin is "Digital Gold". It's important to treat is like such...